Rule of 40 in Services - The 2024 View

We introduced the Rule of 40 and its applicability to technology services last year (https://alten.capital/blog/applying-the-rule-of-40-to-tech-services). In summary, it is a metric that adds a company’s annual revenue growth and profitability level to create a benchmark that allows it to compare different companies and their performance.

The Rule of 40 is based on the concept that an investor or shareholder would be similarly happy if a company had, for example, 40% revenue growth and breakeven profitability or, to the contrary, no revenue growth and a 40% operating margin. This tradeoff is well understood in software and SaaS businesses.

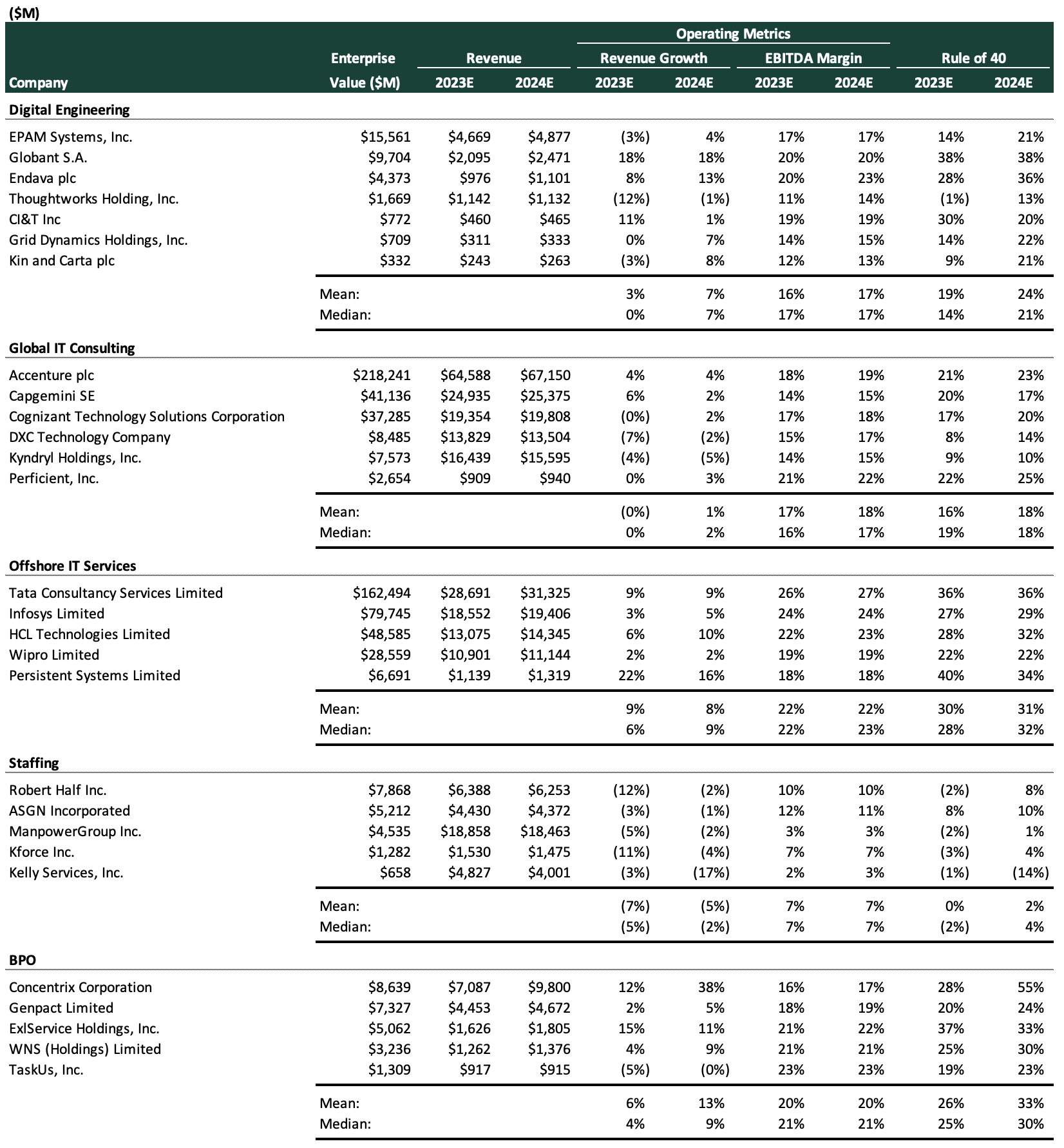

As we take this concept to tech services, we can insert some modifications given the nature of these cash-generating businesses. A mature tech services company with zero EBITDA is uncommon, so we can expect an important component of the Rule of 40 to come from the profitability side. On the other hand, revenue growth could be more volatile than we saw during 2023 and in expectations for 2024. The image below shows an update on the Rule of 40 metrics for a select group of publicly-traded technology services companies.

Revenue growth is barely contributing to the metric overall, although we see an improvement in 2024 expectations relative to 2023. In conclusion, depending on the subsector a company belongs to, approximately 70%- 90% of the Rule of 40 is coming from profitability rather than revenue growth these days (for the largest tech services companies).

At Alten Capital we invest in technology services businesses. Please reach out to explore potential partnerships.