Sizing Up the GCP Services Ecosystem

The penetration of hyperscalers during the last two decades has been robust, starting with the launch of AWS in 2006, GCP (App Engine) in 2008, and Azure in 2010. We previously shared an overview of the AWS services ecosystem: https://alten.capital/blog/cloud-aws-services-partner-ecosystem. We’ll look now at Alphabet’s Google Cloud Platform (https://cloud.google.com/).

The cloud computing market is estimated at approximately $250 billion in 2023. Top providers include AWS with 32% market share, Azure with 23%, and GCP with 10%. Given its size, AWS tends to grow at a ~25% annual rate, Azure at ~30%, and GCP at a ~35% clip.

Each cloud computing platform has partnered with technology services organizations to help migrate workloads to their platforms and increase overall adoption of their computing, storage, networking, databases, analytics, machine learning, and other tools. GCP has more than 2,300 service partners, from which we found relevant data on approximately 2,000 partners.

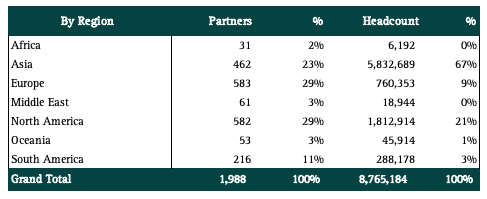

These 1,988 global GCP resellers and service partners employ approximately 9,000,000 people. Company headquarters footprint seems well balanced, with approximately a third of partners in North America and another third in Europe (North America and Europe generally account for 2/3rds of global digital transformation dollars). Asia is third (a quarter of partners), and South America is fourth (11%). Like other partner ecosystems we have analyzed, Asia owns the lion’s share of employees, with 67% of team members employed from this universe of talent.

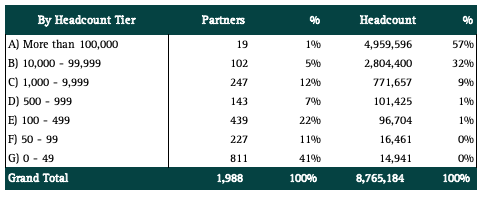

Half of the GCP services partners (more than 1,000 organizations) have fewer than 100 employees. There is a long tail of smaller companies.

At Alten Capital we invest in technology services companies and see value in organizations that align with high-growth platforms. Please contact us to see how we can partner.