Salesforce Consulting and Services Partner Ecosystem Analysis

There is a proven strategy for building services businesses around established ISVs. Salesforce owns one of these mature partner ecosystems, if not the largest and most developed one, outside the hyperscalers. We analyzed the Salesforce consulting and services partner network.

Salesforce is one of the largest software companies worldwide, with 2022 revenues of approximately $31 billion (18% growth from the prior year, with 7.4% of this revenue in professional services). More than 150,000 customers use Salesforce's solutions, from SMBs to enterprise accounts, including 90% of the Fortune 500. Salesforce employs approximately 80,000 team members globally. The Salesforce platform is a de facto standard in CRM, sales, marketing, and revenue-supporting software tools.

The Salesforce partner ecosystem is the largest we could find outside the hyperscalers (AWS, Azure and GCP) estimated at 5x-6x the size of Salesforce itself ($150+ billion). IDC published an in-depth view on the Salesforce economic impact: https://www.salesforce.com/content/dam/web/en_us/www/documents/reports/idc-salesforce-economy-report.pdf. The view is that as Salesforce continues to grow, and their ecosystem continues to flourish, there will be a constant push for talent growth to keep up with that pace. IDC believes the ecosystem has approximately 300,000 people involved, including Salesforce employees. We count approximately 70,000 certified experts from the data we collected (more on that below), creating a relevant skills gap that is expected to continue to increase.

The AppExchange lists 2,500+ consulting and services partners: https://appexchange.salesforce.com/consulting. We cleaned up the data based on headcount and other publicly available information and ended up with 2,364 consulting and services partners we could analyze worldwide.

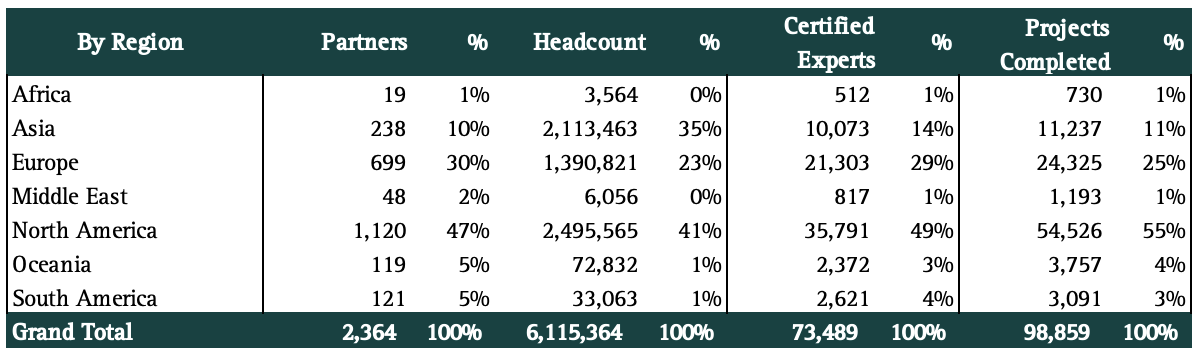

The top partner regions are North America, Europe, and Asia, which match Salesforce's geographical revenues. These consulting partners employ over 6,000,000 people overall and have over 73,000 certified experts (1.2% of the total headcount).

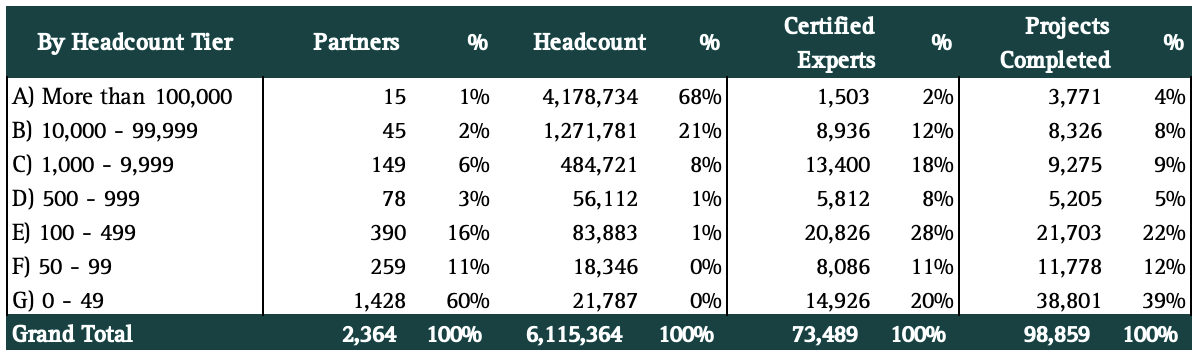

If we cut the data by partner headcount tiers, as expected, we see a larger number of smaller partners. A total of 2,077 partners have fewer than 500 employees (88% of the total), showing a high degree of fragmentation in the space. These smaller partners employ 124,000 experts, representing approximately 2% of the 6,000,000 people employed by all partners worldwide (an average of 60 professionals by partner). These smaller partners have approximately 43,000 certified experts, 35% of their headcount, implying a high focus on Salesforce.

The smaller the partner, the more focused it is on Salesforce. For example, the smallest headcount tier has 15,000 certified experts out of ~22,000 employees overall (69% certification coverage), the next tier (50-99 employees) has 44% certification coverage, 25% for the next tier, 10%, 3%, 1% and 0% certifications for the consulting partners with more than 100,000 employees.

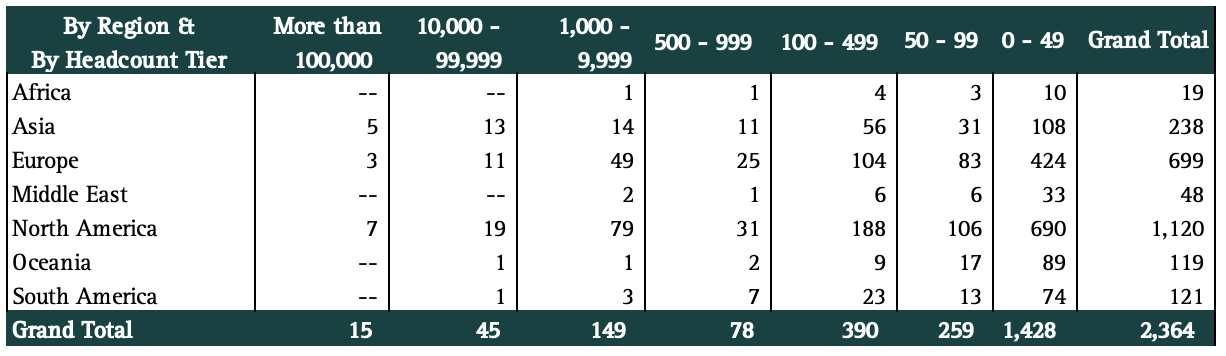

North America and Europe have the highest concentration of smaller-scale Salesforce consulting and services partners worldwide.

At Alten Capital we appreciate the value ISV-related partners bring to supporting the growth of enterprise software platforms. Salesforce owns one of the most mature partner ecosystems, and we expect continued growth. Please reach out to us to explore how we can accelerate your scaling efforts.