Generative AI Impact on Tech Services

During 2023, we’ve had a torrent of news in the generative AI space (GenAI). This AI wave has reached consumers and non-technical users with the availability of OpenAI’s ChatGPT and other simple end-user platforms that showcase the technology’s potential. Capabilities are also expanding exponentially, with some pundits claiming that AI is improving at more than 20x annually. As these improvements materialize, our work and play lives will look quite different a decade from now when computers and systems become experts at helping us.

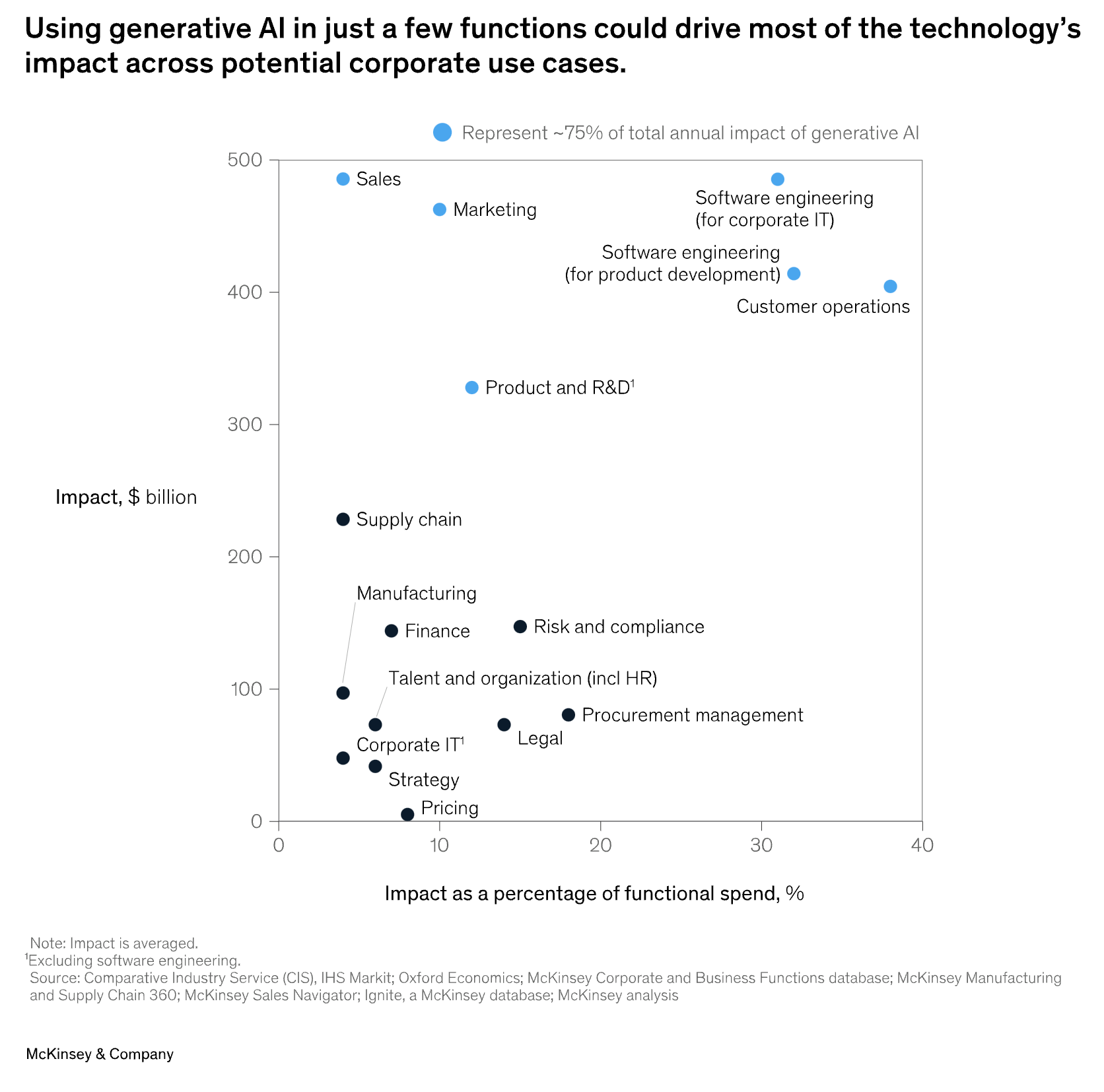

McKinsey recently published a very good article on the economic potential and productivity impact of these new GenAI capabilities. In summary, the strategy and consulting firm sees strong transformations, specifically in sales and marketing, customer operations, and software development functions (75% of the overall value from GenAI cases).

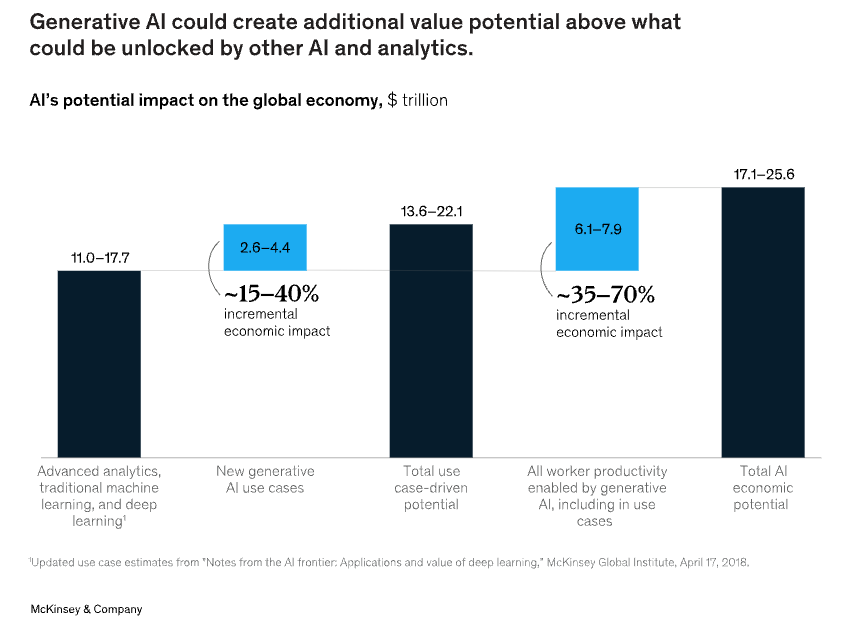

Any small vector change in productivity gains has a tremendous impact on overall economies for the future. For example, McKinsey estimates that GenAI could add up to $4.4 trillion in worldwide GDP annually (as compared to the UK’s GDP in 2021 of $3.1 trillion), on top of the ~$15 trillion economic value that non-GenAI artificial intelligence and analytics automation is expected to add. Banking, tech, and healthcare are large enough sectors where a significant impact will be felt.

McKinsey estimates that 25% of total work time requires understanding of natural language, therefore impacting knowledge workers and roles that require educated talent more heavily. Overall, this GDP value creation and productivity enhancements would afford companies and individuals to devote time to other high-impact ideas and initiatives, potentially accelerating the overall rate of change.

McKinsey estimates that, on average, 50% of the work time spent on the 2023 activities surveyed could be automated sometime by 2045 (in ~20 years). In higher-wage countries, automation adoption will be faster. In contrast, adoption will be slower in lower-wage countries where a decision-maker will compare automation costs with the cost of human wages. Adoption takes time.

Software engineering is a relevant function in most companies, and it continues to grow as companies embed software in a wider set of products and services. A study of the impact of AI on developer productivity showed that less experienced software engineers can increase their work output by ~50% (https://arxiv.org/pdf/2302.06590.pdf).

Additionally, we have seen recent announcements by business and tech consulting firms that they commit to investing in AI. Accenture will invest $3 billion in AI during the next three years, EY $2.5 billion over three years, and PwC a billion over three years.

Given this background, we can arrive at a high probability view that GenAI will increase software development productivity, more so at the less experienced professional levels, and help produce higher quality software products (fewer bugs) over time.

How would this play out in the custom software development services industry? Will the financial profile of IT services companies with large proportions of software engineering talent evolve? How will the talent supply and demand imbalance we see today (and expect in the future) for software engineers change?

We do not believe customer tech budgets will shrink in the future. To the contrary, we believe enterprise investments in technology will continue to garner an even higher share of budgets. Similar to how these budgets get deployed today, part of these investments will be executed with in-house staff, while a portion will be channeled with external service providers. As different internal and external groups become more efficient with AI (meaning they can produce quality products faster), enterprise decision-makers will modify their decision parameters to allocate budgets to higher-impact service workloads.

Services companies that rely on AI to complement their team’s efforts will probably need fewer, more experienced engineers to execute similar projects years from now. This means these companies could outperform their peers who are not experts in AI. These AI-fluent IT services companies would capture the market and continue to grow their revenue, maintaining or expanding their margins, while the non-AI laggards would not be able to compete. This process would reduce the number of non-efficient consulting firms while increasing the number of AI-efficient ones, the “haves” and the “have-nots.” Our view is that in a decade, we should see a marked distinction between these two types of IT services companies, and within two decades, we no longer have consulting and services companies that do not rely on AI to produce work.

We also believe the $1.5 trillion market size and revenue levels for technology services will not shrink but continue to expand as enterprises digitize operations and products, with higher gross and operating margins accruing to AI-fluent services organizations.

At Alten Capital we enjoy supporting business services organizations that rely on technology to scale. Please reach out to explore how we can partner.